-

Long-Term Iron Ore Price: The Destiny of Industrial Structure2017-06-12 17:12:27

Author: Century Mining Database

Much to the surprise of the analysts, iron ore performed strongly all the way to the end of the first quarter – this despite the ramping up of production from two major new mines, Vale’s 5110 in Brazil, and Australia’s Roy Hill. As there have been no fundamental changes to the industry’s dynamics, many see the stronger prices as a blip and continue to hold a pessimistically lower long-term view of the price of iron.

The true question when it comes to forecasting the long-term price is: could there be two price outcomes, given one set of fundamental supply and demand data? I argue that under the current structure of the steel and iron ore industries, analysis of the same fundamentals could produce two possible outcomes: a lower long-term equilibrium price of iron ore, or a higher level driven by pricing power.

China Still at Centre Stage

China has definitely been at centre stage since the turn of the century, and will be for decades to come. The country has huge infrastructure projects and a gigantic housing market, but only small and low-grade iron ore reserves. This creates a growing dependency, now approaching 90%, on imported iron ore, making a price taker position inevitable.

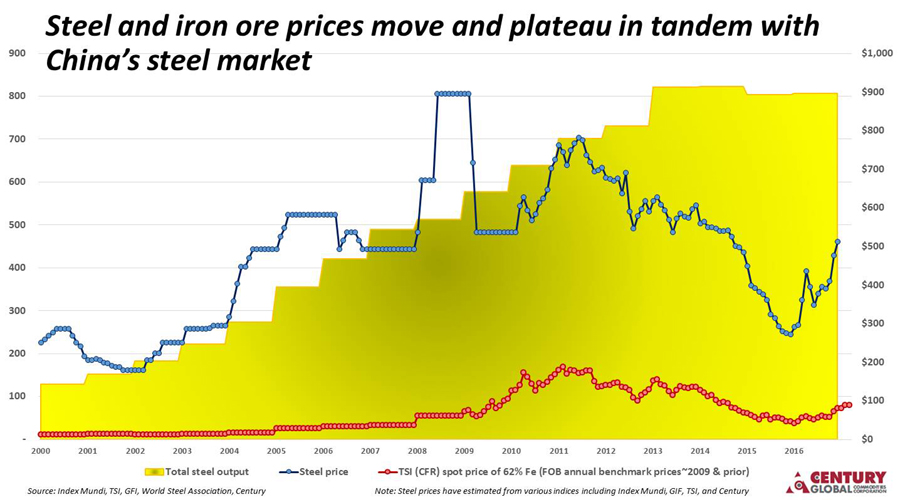

We have seen the growth of steel production driving the growth of iron ore demand in China, which has required the import of some 70% of total global seaborne iron ore supply, exceeding one billion tonnes a year since 2015. The following chart shows how China’s steel demand has been driving steel and iron ore prices over the years.

A Truly Free Market: The Construction Industry Drives Demand

Steel and iron ore are so inter-related that it may be unclear which drives the iron ore market. The ultimate driver is China’s construction market. The country accomplished an unprecedented and successful housing reform to transition to a market economy of 1.4 billion people. This secular housing boom liberated extraordinary market forces, which are felt not only in China, but also all over the world a decade and a half later. Over and above the housing demand, China has grown its massive economy to the point where it has both the capital and technical expertise to embark on mega-infrastructure projects on an historic scale, adding even more to the construction demand. To see the correlation better, the following charts show how China’s growth drove the price of steel, and therefore iron ore, in the first decade of the century.

Steel and iron ore prices have fallen since China reached peak steel production in 2014. However, we have seen adjustment to the new normal in the last two years and the recovery of these prices.

Going forward, the One Belt One Road initiative should be able to meet the long-term demand it will generate by drawing on China’s modern and updated steelmaking capacity, mostly built with scale and state-of-the-art production efficiency.

The Revolutionary Change in Pricing Regime

While the above chart shows the general correlation between steel and iron prices, the chart below shows, on an appropriate scale, how the prices of the two commodities follow each other, and the clear price pattern or regime change initiated by one of the major iron ore producers after the global financial crisis in 2009, when the world switched away from long-term negotiated contracts based on annual benchmark pricing.

However, it is interesting to see that under the long-term contract regime, which provided decades of stability to the high capital-intensive steelmaking and iron ore mining businesses, iron ore miners were losing out. Steel prices rose more quickly, leaving a growing price gap, until it narrowed when this regime collapsed. During this period, steelmakers were doing better than iron ore miners, as the system was working against the miners.

The Free Market to the Strong in an Oligopoly

Realizing their disadvantage and awakening to their pricing power as an oligopoly, iron ore miners took the offensive to dismantle the long-term contract regime and drive the industry to a new spot market regime.

Over and above its position as an oligopoly, industry concentration in the iron ore sector gives it much greater clout than a fragmented steelmaking sector. The top five iron ore miners were at about 70% of the global seaborne market in 2015 and growing, while the top five steelmakers had only 17% of global production.

The net effect of a spot market regime and a highly concentrated oligopoly places iron ore miners in a position to take a higher share of the profit content in the price of steel on a market basis. Rather than a cost-plus-based pricing model, the miners can execute a full market-based one and are positioned to maximize profitability when steel prices rise.

Industry structures evolve over time and come into being as a result of economic development and business consolidation. The current structure in steel and iron ore will dictate the pricing regime for some time to come, or at least until the next cycle. While history tends to repeat itself, there is always an unpredictable turn of events that can turn the tables, such as the price regime change. Perhaps in the long term, the industry will revert to stability of return and investment in such high capital-intensive industries, returning to the orderly regime of old. Stranger things have happened.