-

US$3/lb Copper – Dream or Reality?2017-06-15 13:00:05

2017 Predictions

On April 13, 2017 copper closed at US$2.57/lb., up a dismal 1.6% year to date.

Today’s price follows a five-year decline, after hitting an historic high of $4.61/lb. in February 2011 during the super cycle, and a low of $1.94/lb. in January 2016. This was caused by slowing Chinese demand growth and burgeoning supply, as producers continued to ramp up output, anticipating demand growth similar to 2006-2011 that did not materialize.

For most of 2016, the price ranged between $2.00 and $2.30 lb. before a dramatic uplift in early November. In the second half of 2016, big events rattled markets and shook up copper prices, including the Brexit announcement. The red metal also experienced a surge after the election of Donald Trump.

In the first quarter of 2017, the outlook for copper improved, led by the usually conservative Goldman Sachs, which announced a bullish projection of $2.81/lb. Its previous 2017 six-month call was $2.18/lb., concluding during the first quarter: “The rally in copper prices over the past two months was in sharp contrast to our more bearish expectations.”

Alongside recovering Chinese demand, Citi Research also projected that supply would move into deficit in 2017 for the first time in six years. The supply deficit will prompt copper prices to move above $2.72/lb. in the second half of 2017 and above $3.63/lb. before the end of 2020, Citi predicted.

While price predictions for 2017 are mixed, the consensus currently sits around $2.75/lb. Even the conservative Chilean Copper Commission (Cochilco), is expected to raise the nation’s 2017 budget from $2.20/lb. to the $2.50/lb. range.

Underpinning copper strength to date in 2017 has been the 43-day strike that paralyzed the world's largest copper operation, BHP’s Escondida mine in Chile, as well as protracted shutdowns at two of Freeport MacMoRan’s mines – Grasberg in Indonesia, related to export permits and Cerro Verde in Peru, from strike action.

Antofagusta plc. with several copper mines in Chile, believes a tightening global copper supply will keep prices on the high end of the spectrum this year. In a recent statement, it said: “In the medium term the group expects to see a steady shift from a market in balance to a slight deficit, leading to a further improvement in prices.”

$3.0/lb. for 2017?

So far in 2017, copper has traded between $2.53/lb. and $2.78/lb. As the supply side market was influenced by strikes and other temporary copper mine closures, interest rates continued to strengthen in the US and analyst consensus predictions were raised to $2.75/lb. More recently, potential influences include a much more aggressive US military stance and a maturing opinion of Trump-economics.

Despite an ongoing price decline from mid-February it seems reasonable to align with the analyst consensus of 2.75lb. for 2017 perhaps however with a stronger downside than upside.

To 2020 and Beyond

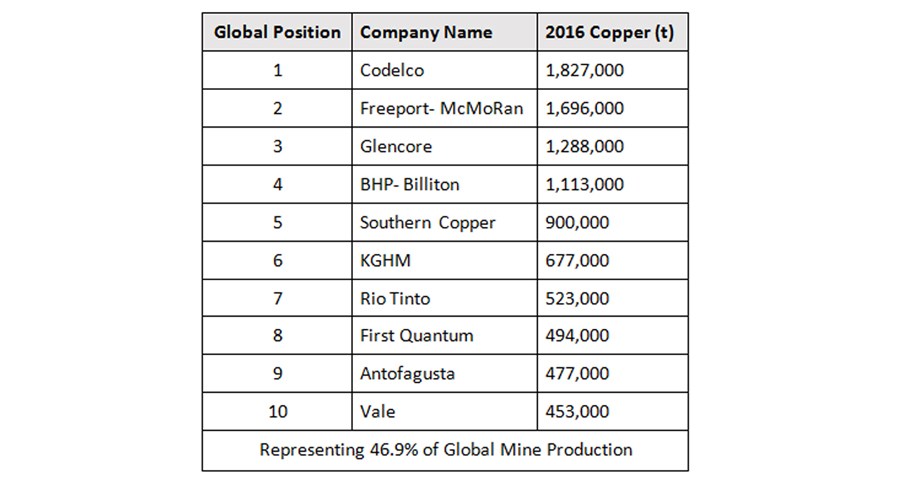

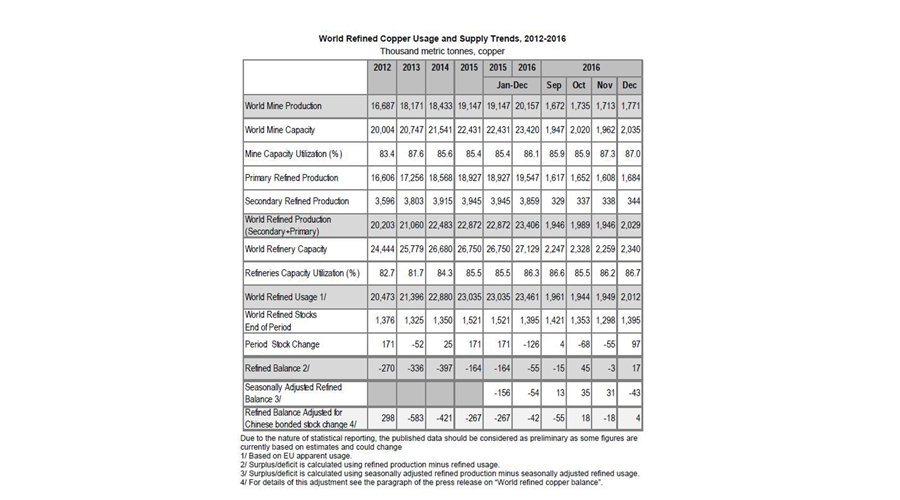

The latest International Copper Study Group (ICSG) report shows world copper mine production jumped by one million tonnes in 2016 to 20.16 million tonnes.

In 2016, world refined copper primary production was 19.6 million tonnes with an overall refined copper negative balance from all sources of 55,000 tonnes, mainly due to a 2.5% uplift in Chinese apparent demand. For December 2016, the balance was a positive 17,000 tonnes.

Extract from ISCG Report

Global copper mine production growth is expected to slow to 2.5% a year through 2020, down from an average growth rate of almost 4% a year over the last five years, ICSG said.

The Portugal-based think tank cited continued delays in project development mainly due to protracted permitting, local community opposition and financing constraints.

PCI Wood Mackenzie, a global commodity research leader, says by 2020, as liquid stocks are eroded sharply lower, they expect a sizeable reaction in prices, with copper set to spike by 2023.

Other end-user sectors expected to increase their copper demand include hybrid-electric vehicles, which use nearly 63 times more copper than a conventional vehicle.

Mine supply is likely to begin moving into a deficit in 2021, but prices will need to rise to around $3.30/lb. for additional mine projects to come online to meet that demand.

$3.0/lb. Long Term?

Although the long-term consensus price starting in 2021 is a little over $3.0/lb., MMG, a dual listed Hong Kong/Australia company with China Minmetals Non-ferrous Metals Co. Ltd. as a principal shareholder, is an outlier, predicting $3.50/lb. long term, with the price rising to $5.0/lb. by 2035.

It seems reasonable to assume a $3.0/lb. is a sustainable copper price by 2020.